Guest Post – Tradition Mortgage’s Weekly Update April 14, 2014

“The one function that TV news performs very well is that when there is no news, we give it to you with the same emphasis as if there were.” David Brinkley. While last week’s economic calendar may have started off on the quiet side, the news picked up steam in the second half of the week. Read on for the highlights.

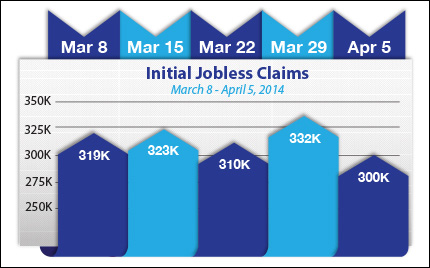

There was good news in the labor markets, as weekly Initial Jobless Claims fell by 32,000 in the latest week to 300,000. This was near a seven-year low and a signal that the labor markets may be coming out of hibernation as spring starts to bloom. In addition the 4-week moving average of claims, which irons out seasonal abnormalities, also fell. Meanwhile, the Consumer Sentiment Index for April came in above expectations, showing that consumers are feeling positive about the economy as we head into warmer months.

There was good news in the labor markets, as weekly Initial Jobless Claims fell by 32,000 in the latest week to 300,000. This was near a seven-year low and a signal that the labor markets may be coming out of hibernation as spring starts to bloom. In addition the 4-week moving average of claims, which irons out seasonal abnormalities, also fell. Meanwhile, the Consumer Sentiment Index for April came in above expectations, showing that consumers are feeling positive about the economy as we head into warmer months.

The housing sector also had good news to report, as foreclosure activity across the nation continues to decline. RealtyTrac reported that foreclosure filings fell to the lowest level since the second quarter of 2007. In addition, March was the forty-second consecutive month where foreclosure activity decreased from the previous year, with foreclosure filings declining by 23 percent from March 2013 to March 2014.

What does this mean for home loan rates? Typically good news helps Stocks improve at the expense of Bonds, including Mortgage Bonds (the type of Bonds on which home loan rates are based). However, Bonds and home loan rates were able to improve last week as the Stock market seemed to begin a correction from recent gains.

In addition, the minutes from the Fed’s March meeting of the Federal Open Market Committee imply that the Fed will continue tapering its Bond and Treasury purchases this year. Remember that the Fed is now purchasing $30 billion in Treasuries and $25 billion in Mortgage Bonds to help stimulate the economy and housing market. This is down from the original $85 billion per month that the Fed had been purchasing. Additional tapering of these purchases will continue to impact our economy and home loan rates as we move ahead this year, and this is an important story to monitor.

The bottom line is that now remains a great time to consider a home purchase or refinance, as home loan rates remain attractive compared to historical levels. Let me know if I can answer any questions at all for you or your clients.

Jim Krantz

Vice President

NMLS # 761955

Jim.Krantz@TraditionLLC.com

Direct 952.252.4488 / Cell 612.716.9999 / Fax 952.252.4489

Tradition Mortgage LLC

4350 Baker Rd Suite 190 / Minnetonka, MN 55343 / www.TraditionWest.com