Guest Post – Tradition Mortgage’s Weekly Update July 21, 2014

Some like it hot. That sentiment does not apply to the Bond markets, when it comes to hotter than expected inflation. Learn what sectors of the economy are heating up, which ones are cooling off—and how the markets and rates responded.

Housing Starts were gloomy in June, as they declined by 9.3 percent from May to an annual rate of 893,000, well below the 1.020 million expected. This was the slowest pace in nine months, led by a drop in single-family homes and apartments. Building Permits, a sign of future construction, also fell by 4.2 percent to an annual rate of 963,000, coming in below expectations. There was a bright spot, as the National Association of Home Builders Housing Market Index came in at 53. Readings above 50 indicate that builders see conditions as good, and this was the first reading above 50 this year. Overall, the housing sector has shown signs of recovery, but activity has leveled off and some readings this year continue to be disappointing.

Housing Starts were gloomy in June, as they declined by 9.3 percent from May to an annual rate of 893,000, well below the 1.020 million expected. This was the slowest pace in nine months, led by a drop in single-family homes and apartments. Building Permits, a sign of future construction, also fell by 4.2 percent to an annual rate of 963,000, coming in below expectations. There was a bright spot, as the National Association of Home Builders Housing Market Index came in at 53. Readings above 50 indicate that builders see conditions as good, and this was the first reading above 50 this year. Overall, the housing sector has shown signs of recovery, but activity has leveled off and some readings this year continue to be disappointing.

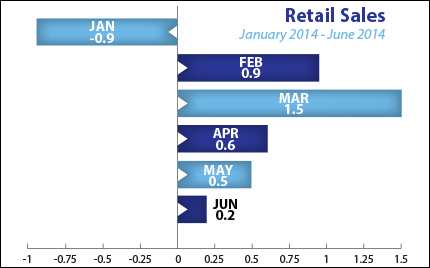

Retail Sales for June also cooled, coming in at the lowest level since the near -1.0 percent recorded in January. Retail Sales account for about one-third of consumer spending, and they are one of the main drivers of U.S. economic activity, making this report an important one to monitor. On a bright side, the report showed that consumers continue to spend at a better than modest pace.

Meanwhile, the Producer Price Index for June showed that inflation at the wholesale level came in hotter than expected. Remember that inflation is the arch enemy of Bonds, as it reduces the value of fixed investments like Bonds. And since home loan rates are tied to Mortgage Bonds, when inflation heats up, Bonds and home loan rates typically worsen. The upcoming Consumer Price Index for June will be closely watched for any signs that inflation is heating up at the consumer level.

What does this mean for home loan rates? If inflation continues to heat up, it could have a negative impact on Bonds and home loan rates, as we saw early last week. However, the continued tensions in the Ukraine and the Middle East could keep investors in the safe haven of the Bond markets, which would help home loan rates in the process. And earnings season is sure to have an impact—if numbers disappoint, Bonds and home loan rates could benefit.

The bottom line is that home loan rates remain near some of their best levels of the year and now is a great time to consider a home purchase or refinance.